Having one, making it clear, telling your kids all about it, and sticking to it.

A financial philosophy is both how you think about money, and what guides your decision making. It's the knowledge, attitudes and values about money you’ve gathered from the sum of all your experiences. Some of it might be well thought out, some of it might be hidden from view,, and some of it might be the scars from the small (or large!) mistakes we (or our own parents) made along the way - all those little whoopsies and wins add up. Either way, we think it’s something to talk about here, and with our kids at home. Because, let’s face it…we often need something to guide us - we’re not perfect and we have lapses of judgement too - and our kids see EVERYTHING! So making a clear financial philosophy helps us, and helps us teach our kids too. So, as you’re setting up your kids in NZ’s first tailored youth accounts, have a think about the following:

Name it, Do it.

Start by grabbing a glass of wine or a cup of tea, talk it out and write it down, making it as clear and simple as you can (after all, you’ll be saying it a thousand times). Then, when the philosophy is in action (paying the bills, deciding between ice cream and ice blocks, buying Xmas presents…whatever), say it out loud and live it with our kids. Pretty much that’s it. “What I say is what I do, and this is why…”.

I am, We are.

Personality comes into it too. One parent’s personality might be frugal and careful, and the other one might go all out on big gifts at birthdays, generous to a fault. Your family too can have a ‘personality’. This is the “this is what we do around here” mantra. This sort of language means our kids get a sense of who they are too, and why it matters.

Own it, Learn from it.

Everyone makes mistakes. Talk about it. Be open. We let our kids see how we deal with it, learn from it, and make different decisions in the future. Also when we’ve done something great too. We reward ourselves and let our kids share the goods too. “The ice creams are on me, ‘cos I reached my savings goal for our summer holiday trip!”.

Here’s our list - the SquareOne Financial Philosophy

- We don't think money is everything. In fact, the most important stuff is free. But, being good with money makes things easier in life, and gives you more time and freedom to focus on those important things.

- Everyone can be great with money. Regardless of where you start, you can learn the good habits, attitudes and behaviours that make you great with money.

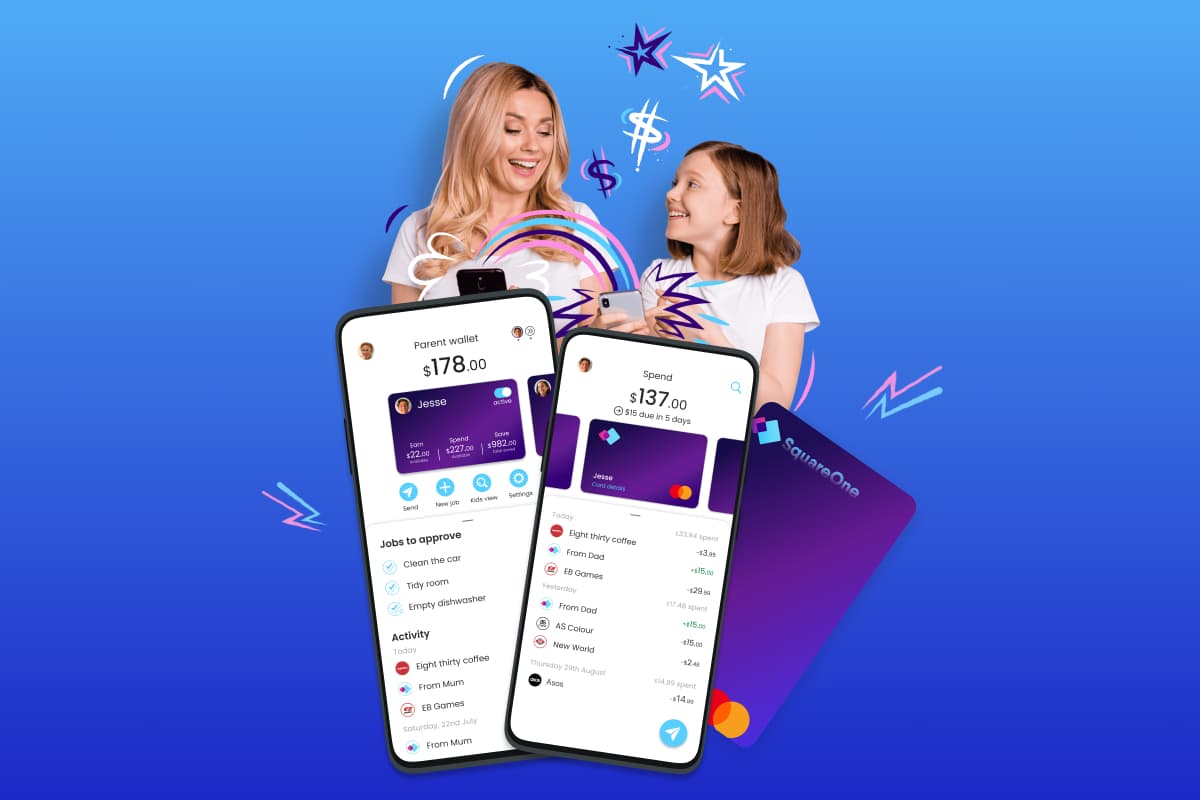

- The future is here, and more still to come. The old system of coins in piggy banks (or that little book you got at school for your first bank account) is fine up to a point, but no longer serves young people in a cashless, digital age. There is more complexity across financial systems, and young people need their money education and their first account to meet their needs now and in the future.

- Money can be epic. Being great with money, making smart choices, and using your brain to think through decisions, can be cool.

- Being great with money takes time. This is one for the books - a long-term parenting project, the highs and the lows, the mistakes and the wins, the epic battle between good and evil - but it all takes time. Go slow, take your time, be consistent, get them started early, walk the talk, talk all the time, and invest in their future.